Announces successful design-wins with Smartphone Chinese OEMs

Financial Highlights

- Q4 revenue of $50.8 million was near the low-end of our guidance range.

- Q4 gross profit margin was 22.7%, near the low-end of our guidance range.

- Ended Q4 with no debt and cash of $158.1 million.

- Repurchased approximately $8.2 million of stock during the quarter.

- Full-year revenue of $230.1 million decreased 31.9% YoY.

- Full-year gross profit margin was 22.4%, down 760 bps YoY.

Operational Highlights

- Secured 1st design-win and began initial shipment in Q4 for first generation OLED DDIC for after-service market.

- Secured 2nd design-win following quarter close with leading Chinese smartphone OEM for spring launch.

- Entered into strategic commercial partnership with Chinese watch solution provider to collaborate on OLED smartwatch display market.

- Display and Power business separation and entity restructuring completed effective with the start of 2024; New businesses MSS (Mixed-Signal Solutions) and PAS (Power-Analog Solutions)*

SEOUL, South Korea–(BUSINESS WIRE)–Feb. 28, 2024– Magnachip Semiconductor Corporation (NYSE: MX) (“Magnachip” or the “Company”) today announced financial results for the fourth quarter and full-year 2023.

YJ Kim, Magnachip’s Chief Executive Officer commented, “As we reflect on the past year and look ahead, we’re shaping our future with the transformation of our business. First, we have shifted our Display business to be laser-focused on the burgeoning OLED market in China and our efforts there are already showing promising results. We now have two design-wins and a dedicated team on the ground to help build on this momentum. Additionally, we are working to optimize our Gumi Fab to transition from lower-margin Transitional Foundry Services to higher-margin Power products. Finally, we’ve restructured our company to streamline operations, enhance shareholder value and increase transparency for our investors with the completion of our legal separation of historical Display and Power businesses into MSS and PAS.”

YJ continued, “Looking ahead, for full year 2024, we currently expect double-digit revenue growth in both the newly organized MSS and PAS businesses. We currently expect total consolidated company revenue for full year 2024 to remain relatively flat to slightly up due to the phase-out of Transitional Foundry Services. We also anticipate PAS gross margin to be challenged during the transition period while we convert the Transitional Foundry Services capacity to Power capacity, but we are committed to navigating this period with a clear focus on long-term value creation for shareholders.”

____________

*MSS consists of historical Display and Power IC business, which is operated by Magnachip Mixed-Signal, Ltd., a limited liability company incorporated in Korea. PAS business is operated by Magnachip Semiconductor, Ltd., the existing limited liability company incorporated in Korea.

Q4 and 2023 Financial Highlights

|

|

|

In thousands of U.S. dollars, except share data

|

|

|

|

|

|

GAAP

|

|

|

|

|

Q4 2023

|

|

|

Q3 2023

|

|

|

Q/Q change

|

|

|

Q4 2022

|

|

|

Y/Y change

|

|

|

Revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Standard Products Business

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Display Solutions

|

|

|

5,232

|

|

|

|

6,404

|

|

|

|

down

|

|

18.3

|

%

|

|

|

7,556

|

|

|

|

down

|

|

30.8

|

%

|

|

Power Solutions

|

|

|

35,950

|

|

|

|

45,215

|

|

|

|

down

|

|

20.5

|

%

|

|

|

46,271

|

|

|

|

down

|

|

22.3

|

%

|

|

Transitional Fab 3 foundry services(1)

|

|

|

9,640

|

|

|

|

9,626

|

|

|

|

up

|

|

0.1

|

%

|

|

|

7,163

|

|

|

|

up

|

|

34.6

|

%

|

|

Gross Profit Margin

|

|

|

22.7

|

%

|

|

|

23.6

|

%

|

|

|

down

|

|

0.9

|

%pts

|

|

|

26.4

|

%

|

|

|

down

|

|

3.7

|

%pts

|

|

Operating Loss

|

|

|

(15,935

|

)

|

|

|

(9,235

|

)

|

|

|

down

|

|

n/a

|

|

|

|

(10,117

|

) |

|

|

|

down

|

|

n/a

|

|

|

Net Income (Loss)

|

|

|

(6,040

|

)

|

|

|

(5,165

|

)

|

|

|

down

|

|

n/a

|

|

|

|

2,971

|

|

|

|

down

|

|

n/a

|

|

|

Basic Earnings (Loss) per Common Share

|

|

|

(0.16

|

)

|

|

|

(0.13

|

)

|

|

|

down

|

|

n/a

|

|

|

|

0.07

|

|

|

|

down

|

|

n/a

|

|

|

Diluted Earnings (Loss) per Common Share

|

|

|

(0.16

|

)

|

|

|

(0.13

|

)

|

|

|

down

|

|

n/a

|

|

|

|

0.07

|

|

|

|

down

|

|

n/a

|

|

|

|

|

|

|

|

In thousands of U.S. dollars, except share data

|

|

|

|

|

Non-GAAP(2)

|

|

|

|

|

|

Q4 2023

|

|

|

Q3 2023

|

|

|

Q/Q change

|

|

|

Q4 2022

|

|

|

Y/Y change

|

|

|

Adjusted Operating Loss

|

|

|

(14,095

|

)

|

|

|

(7,064

|

)

|

|

|

down

|

|

n/a

|

|

|

|

(8,567

|

)

|

|

|

down

|

|

n/a

|

|

|

Adjusted EBITDA

|

|

|

(9,972

|

)

|

|

|

(2,735

|

)

|

|

|

down

|

|

n/a

|

|

|

|

(4,768

|

)

|

|

|

down

|

|

n/a

|

|

|

Adjusted Net Loss

|

|

|

(8,044

|

)

|

|

|

(1,591

|

)

|

|

|

down

|

|

n/a

|

|

|

|

(15,848

|

)

|

|

|

up

|

|

n/a

|

|

|

Adjusted Loss per Common Share—Diluted

|

|

|

(0.21

|

)

|

|

|

(0.04

|

)

|

|

|

down

|

|

n/a

|

|

|

|

(0.36

|

)

|

|

|

up

|

|

n/a

|

|

|

|

In thousands of U.S dollars, except share data

|

|

|

|

GAAP

|

|

|

|

2023

|

|

2022

|

|

Y/Y Change

|

|

|

Revenues

|

|

|

|

|

|

|

|

Standard Products Business

|

|

|

|

|

|

|

|

Display Solutions

|

32,134

|

|

71,432

|

|

down

|

55.0

|

%

|

|

Power Solutions

|

163,556

|

|

230,464

|

|

down

|

29.0

|

%

|

|

Transitional Fab 3 foundry services(1)

|

34,361

|

|

35,762

|

|

down

|

3.9

|

%

|

|

Gross Profit Margin

|

22.4

|

%

|

30.0

|

%

|

down

|

7.6

|

pts

|

|

Operating Loss

|

(57,644

|

)

|

(5,244

|

)

|

down

|

n/a

|

|

|

Net Loss

|

(36,622

|

)

|

(8,036

|

)

|

down

|

n/a

|

|

|

Basic Loss per Common Share

|

(0.89

|

)

|

(0.18

|

)

|

down

|

n/a

|

|

|

Diluted Loss per Common Share

|

(0.89

|

)

|

(0.18

|

)

|

down

|

n/a

|

|

|

|

|

|

|

|

|

In thousands of U.S dollars, except share data

|

|

|

|

|

|

|

|

|

Non-GAAP(2)

|

|

|

|

|

|

|

|

|

2023

|

|

|

2022

|

|

Y/Y Change

|

|

|

Adjusted Operating Income (Loss)

|

|

|

|

|

(41,170

|

)

|

|

|

4,091

|

|

down

|

|

n/a

|

|

|

Adjusted EBITDA

|

|

|

|

|

(24,174

|

)

|

|

19,517

|

|

down

|

|

n/a

|

|

|

Adjusted Net Income (Loss)

|

|

|

|

|

(22,474

|

)

|

|

|

8,752

|

|

down

|

|

n/a

|

|

|

Adjusted Earnings (Loss) per Common Share—Diluted

|

|

|

|

|

(0.55

|

)

|

|

0.19

|

|

down

|

|

n/a

|

|

___________

| (1) |

|

Following the consummation of the sale of the Foundry Services Group business and Fab 4 in Q3 2020, we provided transitional foundry services to the buyer for foundry products manufactured in our fabrication facility located in Gumi, Korea, known as “Fab 3” (“Transitional Fab 3 Foundry Services”). The contractual obligation to provide the Transitional Fab 3 Foundry Services ended August 31, 2023, and we are planning to wind down these foundry services and convert portions of the idle capacity to PAS products beginning around the second half of 2024. Because these foundry services during the wind-down period are still provided to the same buyer by us using our Fab 3 based on mutually agreed terms and conditions, we will continue to report our revenue from providing these foundry services and related cost of sales within the Transitional Fab 3 Foundry Services line in our consolidated statement of operations until such wind down is completed. Management believes that disclosing revenue of Transitional Fab 3 Foundry Services separately from the standard products business allows investors to better understand the results of our core standard products display solutions and power solutions businesses. |

|

|

|

| (2) |

|

Management believes that non-GAAP financial measures, when viewed in conjunction with GAAP results, can provide a meaningful understanding of the factors and trends affecting our business and operations and assist in evaluating our core operating performance. However, such non-GAAP financial measures have limitations and should not be considered as a substitute for net income (loss) or as a better indicator of our operating performance than measures that are presented in accordance with GAAP. A reconciliation of GAAP results to non-GAAP results is included in this press release. |

Q1 and 2024 Financial Guidance

Beginning in Q1, the Company will begin reporting results under its newly organized businesses: MSS (Mixed-Signal Solutions) and PAS (Power-Analog Solutions). While actual results may vary, Magnachip currently expects the following:

For Q1 2024:

- Consolidated revenue to be in the range of $46 to $51 million, including approximately $3 million of Transitional Foundry Services.

- MSS revenue to be in the range of $8 to $10 million. This compares with MSS equivalent revenue of $8.6 million in Q4 2023.

- PAS revenue to be in the range of $35 to $38 million. This compares with PAS equivalent revenue of $32.6 million in Q4 2023.

- Consolidated gross profit margin to be in the range of 17% to 20%.

- MSS gross profit margin to be in the range of 40% to 43%, which includes the positive impact of expected one-time non-recurring engineering revenue. This compares with MSS equivalent gross profit margin of 41.3% in Q4 2023, which also included one-time non-recurring engineering revenue.

- PAS gross profit margin to be in the range of 15% to 18% due primarily to the expected decline in Transitional Foundry Services revenue. This compares with PAS equivalent gross profit margin of 18.0% in Q4 2023.

For the full-year 2024:

- MSS revenue to grow double digits year-over-year as compared with MSS equivalent revenue of $44.4 million in 2023.

- PAS revenue to grow double digits year-over-year as compared with PAS equivalent revenue of $151.3 million in 2023.

- Consolidated revenue flat-to-up-slightly year-over-year as recovery in MSS and PAS is offset by the phase-out of Transitional Foundry Services.

- Consolidated gross profit margin between 17% to 20% due to idle capacity expected from the phase-out of Transitional Foundry Services. This compares with the consolidated gross profit margin of 22.4% in 2023.

Q4 2023 Earnings Conference Call

Magnachip will host a corresponding conference call at 2:00 p.m. PT / 5:00 p.m. ET on Wednesday, February 28, 2024, to discuss its financial results. In advance of the conference call, all participants must use the following link to complete the online registration process. Upon registering, each participant will receive access details for this event including the dial-in numbers, a PIN number, and an e-mail with detailed instructions to join the conference call. A live and archived webcast of the conference call and a copy of earnings release will be accessible from the ‘Investors’ section of the Company’s website at www.magnachip.com.

Online registration: https://register.vevent.com/register/BI736feb7bc081454c8d811cbbeb6b92dc

Safe Harbor for Forward-Looking Statements

Information in this release regarding Magnachip’s forecasts, business outlook, expectations and beliefs are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. These statements include expectations about estimated historical or future operating results and financial performance, outlook and business plans, including first quarter and full year 2024 revenue and gross profit margin expectations, future growth and revenue opportunities from new and existing products and customers, the timing and extent of future revenue contributions by our products and businesses, and the impact of market conditions associated with inflation and higher interest rates, remaining effects from the COVID-19 pandemic, geopolitical conflicts between Russia-Ukraine and between Israel-Hamas, sustained military action and conflict in the Red Sea, and trade tensions between the U.S. and China, on Magnachip’s first quarter and full year 2024 and future operating results. All forward-looking statements included in this release are based upon information available to Magnachip as of the date of this release, which may change, and we assume no obligation to update any such forward-looking statements. These statements are not guarantees of future performance and actual results could differ materially from our current expectations. Factors that could cause or contribute to such differences include, among others: the impact of changes in macroeconomic conditions, including those caused by or related to inflation, potential recessions or other deteriorations, economic instability or civil unrest; remaining effects from the COVID-19 pandemic, the geopolitical conflicts between Russia-Ukraine and between Israel-Hamas, sustained military action and conflict in the Red Sea, and trade tensions between the U.S. and China; manufacturing capacity constraints or supply chain disruptions that may impact our ability to deliver our products or affect the price of components, which may lead to an increase in our costs and impact demand for our products from customers who are similarly affected by such capacity constraints or disruptions; the impact of competitive products and pricing; timely acceptance of our designs by customers; timely introduction of new products and technologies; our ability to ramp new products into volume production; industry-wide shifts in supply and demand for semiconductor products; overcapacity within the industry or at Magnachip; effective and cost-efficient utilization of manufacturing capacity; financial stability in foreign markets and the impact of foreign exchange rates; unanticipated costs and expenses or the inability to identify expenses that can be eliminated; compliance with U.S. and international trade and export laws and regulations by us, our customers and our distributors; change to or ratification of local or international laws and regulations, including those related to environment, health and safety; public health issues, including the remaining effects of the COVID-19 pandemic; other business interruptions that could disrupt supply or delivery of, or demand for, Magnachip’s products; and other risks detailed from time to time in Magnachip’s filings with the U.S. Securities and Exchange Commission (the “SEC”), including our Form 10-K filed on February 22, 2023, and subsequent registration statements, amendments or other reports that we may file from time to time with the SEC and/or make available on our website. Magnachip assumes no obligation and does not intend to update the forward-looking statements provided, whether as a result of new information, future events or otherwise.

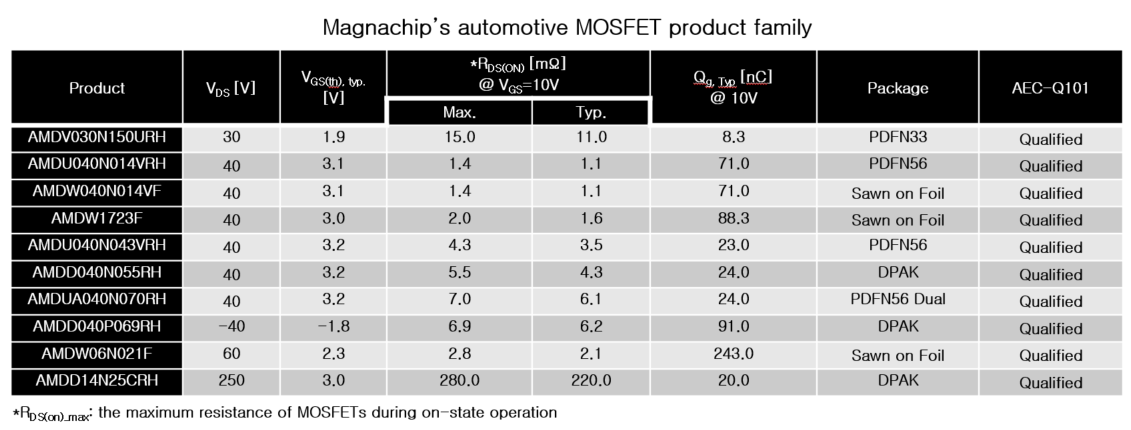

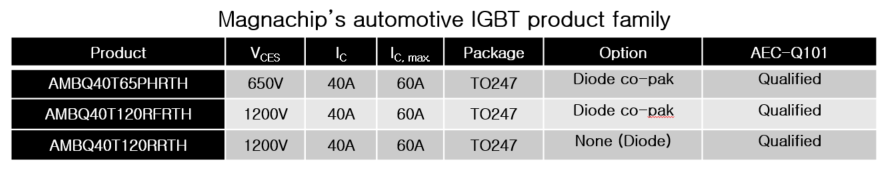

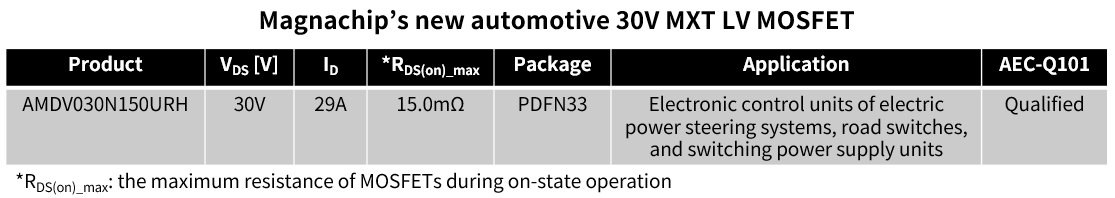

About Magnachip Semiconductor

Magnachip is a designer and manufacturer of analog and mixed-signal semiconductor platform solutions for communication, Internet of Things (“IoT”), consumer, computing, industrial and automotive applications. The Company provides a broad range of standard products to customers worldwide. Magnachip, with more than 40 years of operating history, owns a portfolio of approximately 1,100 registered patents and pending applications, and has extensive engineering, design, and manufacturing process expertise. For more information, please visit www.magnachip.com. Information on or accessible through Magnachip’s website is not a part of, and is not incorporated into, this release.

|

MAGNACHIP SEMICONDUCTOR CORPORATION AND SUBSIDIARIES

|

|

CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

(In thousands of U.S. dollars, except share data)

|

|

(Unaudited)

|

|

|

|

|

|

|

Three Months Ended

|

|

Year Ended

|

|

|

December 31,

2023

|

|

September 30,

2023

|

|

December 31,

2022

|

|

December 31,

2023

|

|

December 31,

2022

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

Net sales – standard products business

|

$

|

41,182

|

|

|

$

|

51,619

|

|

|

$

|

53,827

|

|

|

$

|

195,690

|

|

|

$

|

301,896

|

|

|

Net sales – transitional Fab 3 foundry services

|

|

9,640

|

|

|

|

9,626

|

|

|

|

7,163

|

|

|

|

34,361

|

|

|

|

35,762

|

|

|

Total revenues

|

|

50,822

|

|

|

|

61,245

|

|

|

|

60,990

|

|

|

|

230,051

|

|

|

|

337,658

|

|

|

Cost of sales:

|

|

|

|

|

|

|

|

|

|

|

Cost of sales – standard products business

|

|

31,754

|

|

|

|

36,829

|

|

|

|

37,150

|

|

|

|

143,762

|

|

|

|

202,347

|

|

|

Cost of sales – transitional Fab 3 foundry services

|

|

7,541

|

|

|

|

9,935

|

|

|

|

7,742

|

|

|

|

34,649

|

|

|

|

34,047

|

|

|

Total cost of sales

|

|

39,295

|

|

|

|

46,764

|

|

|

|

44,892

|

|

|

|

178,411

|

|

|

|

236,394

|

|

|

Gross profit

|

|

11,527

|

|

|

|

14,481

|

|

|

|

16,098

|

|

|

|

51,640

|

|

|

|

101,264

|

|

|

Gross profit as a percentage of standard products business net sales

|

|

22.9

|

%

|

|

|

28.7

|

%

|

|

|

31.0

|

%

|

|

|

26.5

|

%

|

|

|

33.0

|

%

|

|

Gross profit as a percentage of total revenues

|

|

22.7

|

%

|

|

|

23.6

|

%

|

|

|

26.4

|

%

|

|

|

22.4

|

%

|

|

|

30.0

|

%

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses

|

|

12,079

|

|

|

|

12,089

|

|

|

|

12,562

|

|

|

|

48,470

|

|

|

|

50,872

|

|

|

Research and development expenses

|

|

15,383

|

|

|

|

11,627

|

|

|

|

13,653

|

|

|

|

51,563

|

|

|

|

52,338

|

|

|

Early termination and other charges, net

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

9,251

|

|

|

|

3,298

|

|

|

Total operating expenses

|

|

27,462

|

|

|

|

23,716

|

|

|

|

26,215

|

|

|

|

109,284

|

|

|

|

106,508

|

|

|

Operating loss

|

|

(15,935

|

)

|

|

|

(9,235

|

)

|

|

|

(10,117

|

)

|

|

|

(57,644

|

)

|

|

|

(5,244

|

)

|

|

Interest income

|

|

2,519

|

|

|

|

2,382

|

|

|

|

2,420

|

|

|

|

10,435

|

|

|

|

5,980

|

|

|

Interest expense

|

|

(183

|

)

|

|

|

(189

|

)

|

|

|

(269

|

)

|

|

|

(828

|

)

|

|

|

(1,157

|

)

|

|

Foreign currency gain (loss), net

|

|

5,241

|

|

|

|

(2,583

|

)

|

|

|

17,492

|

|

|

|

465

|

|

|

|

(3,019

|

)

|

|

Other income (loss), net

|

|

(42

|

)

|

|

|

87

|

|

|

|

(42

|

)

|

|

|

13

|

|

|

|

561

|

|

|

Loss before income tax expense (benefit)

|

|

(8,400

|

)

|

|

|

(9,538

|

)

|

|

|

9,484

|

|

|

|

(47,559

|

)

|

|

|

(2,879

|

)

|

|

Income tax expense (benefit)

|

|

(2,360

|

)

|

|

|

(4,373

|

)

|

|

|

6,513

|

|

|

|

(10,937

|

)

|

|

|

5,157

|

|

|

Net income (loss)

|

$

|

(6,040

|

)

|

|

$

|

(5,165

|

)

|

|

$

|

2,971

|

|

|

$

|

(36,622

|

)

|

|

$

|

(8,036

|

)

|

|

Basic earnings (loss) per common share—

|

$

|

(0.16

|

)

|

|

$

|

(0.13

|

)

|

|

$

|

0.07

|

|

|

$

|

(0.89

|

)

|

|

$

|

(0.18

|

)

|

|

Diluted earnings (loss) per common share—

|

$

|

(0.16

|

)

|

|

$

|

(0.13

|

)

|

|

$

|

0.07

|

|

|

$

|

(0.89

|

)

|

|

$

|

(0.18

|

)

|

|

Weighted average number of shares—

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

38,834,451

|

|

|

|

40,145,290

|

|

|

|

44,054,275

|

|

|

|

41,013,069

|

|

|

|

44,850,791

|

|

|

Diluted

|

|

38,834,451

|

|

|

|

40,145,290

|

|

|

|

44,731,683

|

|

|

|

41,013,069

|

|

|

|

44,850,791

|

|

|

MAGNACHIP SEMICONDUCTOR CORPORATION AND SUBSIDIARIES

|

|

CONSOLIDATED BALANCE SHEETS

|

|

(In thousands of U.S. dollars, except share data)

|

|

(Unaudited)

|

|

|

|

|

|

December 31,

2023

|

|

December 31,

2022

|

|

Assets

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

158,092

|

|

|

|

$

|

225,477

|

|

|

Accounts receivable, net

|

|

|

32,641

|

|

|

|

|

35,380

|

|

|

Inventories, net

|

|

|

32,733

|

|

|

|

|

39,883

|

|

|

Other receivables

|

|

|

4,295

|

|

|

|

|

7,847

|

|

|

Prepaid expenses

|

|

|

7,390

|

|

|

|

|

10,560

|

|

|

Hedge collateral

|

|

|

1,000

|

|

|

|

|

2,940

|

|

|

Other current assets

|

|

|

9,283

|

|

|

|

|

15,766

|

|

|

Total current assets

|

|

|

245,434

|

|

|

|

|

337,853

|

|

|

Property, plant and equipment, net

|

|

|

100,122

|

|

|

|

|

110,747

|

|

|

Operating lease right-of-use assets

|

|

|

4,639

|

|

|

|

|

5,265

|

|

|

Intangible assets, net

|

|

|

1,537

|

|

|

|

|

1,930

|

|

|

Long-term prepaid expenses

|

|

|

5,736

|

|

|

|

|

10,939

|

|

|

Deferred income taxes

|

|

|

50,836

|

|

|

|

|

38,324

|

|

|

Other non-current assets

|

|

|

12,187

|

|

|

|

|

11,587

|

|

|

Total assets

|

|

$

|

420,491

|

|

|

|

$

|

516,645

|

|

|

Liabilities and Stockholders’ Equity

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

24,443

|

|

|

|

$

|

17,998

|

|

|

Other accounts payable

|

|

|

5,292

|

|

|

|

|

9,702

|

|

|

Accrued expenses

|

|

|

10,457

|

|

|

|

|

9,688

|

|

|

Accrued income taxes

|

|

|

1,496

|

|

|

|

|

3,154

|

|

|

Operating lease liabilities

|

|

|

1,914

|

|

|

|

|

1,397

|

|

|

Other current liabilities

|

|

|

3,286

|

|

|

|

|

5,306

|

|

|

Total current liabilities

|

|

|

46,888

|

|

|

|

|

47,245

|

|

|

Accrued severance benefits, net

|

|

|

16,020

|

|

|

|

|

23,121

|

|

|

Non-current operating lease liabilities

|

|

|

2,897

|

|

|

|

|

4,091

|

|

|

Other non-current liabilities

|

|

|

10,088

|

|

|

|

|

14,035

|

|

|

Total liabilities

|

|

|

75,893

|

|

|

|

|

88,492

|

|

|

Commitments and contingencies

|

|

|

|

|

|

|

Stockholders’ equity

|

|

|

|

|

|

|

Common stock, $0.01 par value, 150,000,000 shares authorized, 56,971,394 shares issued and 38,852,742 outstanding at December 31, 2023 and 56,432,449 shares issued and 43,824,575 outstanding at December 31, 2022

|

|

|

569

|

|

|

|

|

564

|

|

|

Additional paid-in capital

|

|

|

273,256

|

|

|

|

|

266,058

|

|

|

Retained earnings

|

|

|

298,884

|

|

|

|

|

335,506

|

|

|

Treasury stock, 18,118,652 shares at December 31, 2023 and 12,607,874 shares at December 31, 2022, respectively

|

|

|

(213,454

|

)

|

|

|

|

(161,422

|

)

|

|

Accumulated other comprehensive loss

|

|

|

(14,657

|

)

|

|

|

|

(12,553

|

)

|

|

Total stockholders’ equity

|

|

|

344,598

|

|

|

|

|

428,153

|

|

|

Total liabilities and stockholders’ equity

|

|

$

|

420,491

|

|

|

|

$

|

516,645

|

|

|

MAGNACHIP SEMICONDUCTOR CORPORATION AND SUBSIDIARIES

|

|

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

(In thousands of U.S. dollars)

|

|

(Unaudited)

|

|

|

Three Months

Ended

|

|

Year Ended

|

|

December 31,

2023

|

|

December 31,

2023

|

|

December 31,

2022

|

|

Cash flows from operating activities

|

|

|

|

|

|

|

Net loss

|

$

|

(6,040

|

)

|

|

$

|

(36,622

|

)

|

|

$

|

(8,036

|

)

|

|

Adjustments to reconcile net loss to net cash provided by (used in) operating activities

|

|

|

|

|

|

|

Depreciation and amortization

|

|

4,101

|

|

|

|

16,684

|

|

|

|

15,000

|

|

|

Provision for severance benefits

|

|

(25

|

)

|

|

|

5,333

|

|

|

|

6,289

|

|

|

Loss (gain) on foreign currency, net

|

|

(11,159

|

)

|

|

|

3,373

|

|

|

|

19,729

|

|

|

Provision for inventory reserves

|

|

850

|

|

|

|

3,885

|

|

|

|

9,574

|

|

|

Stock-based compensation

|

|

1,840

|

|

|

|

7,223

|

|

|

|

6,037

|

|

|

Deferred income taxes

|

|

(13,493

|

)

|

|

|

(13,405

|

)

|

|

|

278

|

|

|

Other, net

|

|

165

|

|

|

|

757

|

|

|

|

664

|

|

|

Changes in operating assets and liabilities

|

|

|

|

|

|

|

Accounts receivable, net

|

|

8,318

|

|

|

|

1,909

|

|

|

|

10,276

|

|

|

Inventories

|

|

(1,265

|

)

|

|

|

2,370

|

|

|

|

(12,626

|

)

|

|

Other receivables

|

|

(1,146

|

)

|

|

|

3,847

|

|

|

|

18,146

|

|

|

Prepaid expenses

|

|

3,155

|

|

|

|

8,808

|

|

|

|

8,923

|

|

|

Other current assets

|

|

15,992

|

|

|

|

8,048

|

|

|

|

(13,073

|

)

|

|

Accounts payable

|

|

1,086

|

|

|

|

7,152

|

|

|

|

(16,325

|

)

|

|

Other accounts payable

|

|

(2,196

|

)

|

|

|

(8,934

|

)

|

|

|

(9,410

|

)

|

|

Accrued expenses

|

|

(126

|

)

|

|

|

493

|

|

|

|

(7,228

|

)

|

|

Accrued income taxes

|

|

1,445

|

|

|

|

(1,569

|

)

|

|

|

(8,400

|

)

|

|

Deferred revenue

|

|

782

|

|

|

|

85

|

|

|

|

(1,261

|

)

|

|

Other current liabilities

|

|

(65

|

)

|

|

|

(109

|

)

|

|

|

(645

|

)

|

|

Other non-current liabilities

|

|

41

|

|

|

|

(238

|

)

|

|

|

749

|

|

|

Contributions to severance insurance deposit accounts

|

|

(4,278

|

)

|

|

|

(5,101

|

)

|

|

|

(7,899

|

)

|

|

Payment of severance benefits

|

|

(799

|

)

|

|

|

(6,982

|

)

|

|

|

(6,012

|

)

|

|

Other, net

|

|

(3

|

)

|

|

|

(21

|

)

|

|

|

415

|

|

|

Net cash provided by (used in) operating activities

|

|

(2,820

|

)

|

|

|

(3,014

|

)

|

|

|

5,165

|

|

|

Cash flows from investing activities

|

|

|

|

|

|

|

Proceeds from settlement of hedge collateral

|

|

2,334

|

|

|

|

5,669

|

|

|

|

15,232

|

|

|

Payment of hedge collateral

|

|

(600

|

)

|

|

|

(3,754

|

)

|

|

|

(15,282

|

)

|

|

Proceeds from disposal of property, plant and equipment

|

|

—

|

|

|

|

—

|

|

|

|

550

|

|

|

Purchase of property, plant and equipment

|

|

(4,675

|

)

|

|

|

(6,955

|

)

|

|

|

(23,394

|

)

|

|

Payment for intellectual property registration

|

|

(33

|

)

|

|

|

(263

|

)

|

|

|

(390

|

)

|

|

Collection of guarantee deposits

|

|

—

|

|

|

|

4,984

|

|

|

|

737

|

|

|

Payment of guarantee deposits

|

|

(62

|

)

|

|

|

(7,338

|

)

|

|

|

(2,381

|

)

|

|

Net cash used in investing activities

|

|

(3,036

|

)

|

|

|

(7,657

|

)

|

|

|

(24,928

|

)

|

|

Cash flows from financing activities

|

|

|

|

|

|

|

Proceeds from exercise of stock options

|

|

—

|

|

|

|

27

|

|

|

|

1,786

|

|

|

Acquisition of treasury stock

|

|

(8,695

|

)

|

|

|

(51,782

|

)

|

|

|

(13,960

|

)

|

|

Repayment of financing related to water treatment facility arrangement

|

|

(122

|

)

|

|

|

(493

|

)

|

|

|

(500

|

)

|

|

Others

|

|

(22

|

)

|

|

|

(91

|

)

|

|

|

(70

|

)

|

|

Net cash used in financing activities

|

|

(8,839

|

)

|

|

|

(52,339

|

)

|

|

|

(12,744

|

)

|

|

Effect of exchange rates on cash and cash equivalents

|

|

6,143

|

|

|

|

(4,375

|

)

|

|

|

(21,563

|

)

|

|

Net decrease in cash and cash equivalents

|

|

(8,552

|

)

|

|

|

(67,385

|

)

|

|

|

(54,070

|

)

|

|

Cash and cash equivalents

|

|

|

|

|

|

|

Beginning of the period

|

|

166,644

|

|

|

|

225,477

|

|

|

|

279,547

|

|

|

End of the period

|

$

|

158,092

|

|

|

$

|

158,092

|

|

|

$

|

225,477

|

|

|

MAGNACHIP SEMICONDUCTOR CORPORATION AND SUBSIDIARIES

|

|

RECONCILIATION OF OPERATING LOSS TO ADJUSTED OPERATING INCOME (LOSS)

|

|

(In thousands of U.S. dollars)

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

Year Ended

|

|

|

|

|

December 31,

2023

|

|

|

September 30,

2023

|

|

|

December 31,

2022

|

|

December 31,

2023

|

|

|

December 31,

2022

|

|

|

Operating loss

|

|

$

|

(15,935

|

)

|

|

$

|

(9,235

|

)

|

|

$

|

(10,117

|

)

|

|

|

$

|

(57,644

|

)

|

|

$

|

(5,244

|

)

|

|

|

Adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity-based compensation expense

|

|

|

1,840

|

|

|

|

2,171

|

|

|

|

1,550

|

|

|

|

|

7,223

|

|

|

|

6,037

|

|

|

|

Early termination and other charges, net

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

9,251

|

|

|

|

3,298

|

|

|

|

Adjusted Operating Income (Loss)

|

|

$

|

(14,095

|

)

|

|

$

|

(7,064

|

)

|

|

$

|

(8,567

|

)

|

|

|

$

|

(41,170

|

)

|

|

$

|

4,091

|

|

|

We present Adjusted Operating Income (Loss) as a supplemental measure of our performance. We define Adjusted Operating Income (Loss) for the periods indicated as operating loss adjusted to exclude (i) Equity-based compensation expense and (ii) Early termination and other charges, net.

For the year ended December 31, 2023, Early termination and other charges includes $8,449 thousand of termination related charges in connection with the voluntary resignation program that we offered to certain employees during the first quarter of 2023 and $802 thousand of one-time employee incentives.

For the year ended December 31, 2022, Early termination and other charges, net includes $2,821 thousand of one-time employee incentives and professional service fees and expenses of $1,014 thousand, incurred in connection with certain strategic evaluations, both of which were offset in part by a $537 thousand gain on sale of certain legacy equipment of the closed back-end line in our fabrication facility in Gumi.

|

MAGNACHIP SEMICONDUCTOR CORPORATION AND SUBSIDIARIES

|

|

RECONCILIATION OF NET INCOME (LOSS) TO ADJUSTED EBITDA AND ADJUSTED NET INCOME (LOSS)

|

|

(In thousands of U.S. dollars, except share data)

|

|

(Unaudited)

|

|

|

|

|

|

Three Months Ended

|

|

Year Ended

|

|

|

|

December 31,

2023

|

|

September 30,

2023

|

|

December 31,

2022

|

|

December 31,

2023

|

|

December 31,

2022

|

|

Net Income (Loss)

|

$

|

(6,040

|

)

|

|

$

|

(5,165

|

)

|

|

$

|

2,971

|

|

|

$

|

(36,622

|

)

|

|

$

|

(8,036

|

) |

|

Adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

(2,519

|

)

|

|

|

(2,382

|

)

|

|

|

(2,420

|

)

|

|

|

(10,435

|

)

|

|

|

(5,980

|

) |

|

Interest expense

|

|

183

|

|

|

|

189

|

|

|

|

269

|

|

|

|

828

|

|

|

|

1,157

|

|

|

Income tax expense (benefit)

|

|

(2,360

|

)

|

|

|

(4,373

|

)

|

|

|

6,513

|

|

|

|

(10,937

|

)

|

|

|

5,157

|

|

|

Depreciation and amortization

|

|

4,101

|

|

|

|

4,081

|

|

|

|

3,775

|

|

|

|

16,684

|

|

|

|

15,000

|

|

|

EBITDA

|

|

(6,635

|

)

|

|

|

(7,650

|

)

|

|

|

11,108

|

|

|

|

(40,482

|

)

|

|

|

7,298

|

|

|

Equity-based compensation expense

|

|

1,840

|

|

|

|

2,171

|

|

|

|

1,550

|

|

|

|

7,223

|

|

|

|

6,037

|

|

|

Foreign currency loss (gain), net

|

|

(5,241

|

)

|

|

|

2,583

|

|

|

|

(17,492

|

)

|

|

|

(465

|

)

|

|

|

3,019

|

|

|

Derivative valuation loss (gain), net

|

|

64

|

|

|

|

161

|

|

|

|

66

|

|

|

|

299

|

|

|

|

(135

|

) |

|

Early termination and other charges, net

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

9,251

|

|

|

|

3,298

|

|

|

Adjusted EBITDA

|

$

|

(9,972

|

)

|

|

$

|

(2,735

|

)

|

|

$

|

(4,768

|

)

|

|

$

|

(24,174

|

)

|

|

$

|

19,517

|

|

|

Net Income (Loss)

|

$

|

(6,040

|

)

|

|

$

|

(5,165

|

)

|

|

$

|

2,971

|

|

|

$

|

(36,622

|

)

|

|

$

|

(8,036

|

) |

|

Adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

Equity-based compensation expense

|

|

1,840

|

|

|

|

2,171

|

|

|

|

1,550

|

|

|

|

7,223

|

|

|

|

6,037

|

|

|

Foreign currency loss (gain), net

|

|

(5,241

|

)

|

|

|

2,583

|

|

|

|

(17,492

|

)

|

|

|

(465

|

)

|

|

|

3,019

|

|

|

Derivative valuation loss (gain), net

|

|

64

|

|

|

|

161

|

|

|

|

66

|

|

|

|

299

|

|

|

|

(135

|

) |

|

Early termination and other charges, net

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

9,251

|

|

|

|

3,298

|

|

|

Income tax effect on non-GAAP adjustments

|

|

1,333

|

|

|

|

(1,341

|

)

|

|

|

(2,943

|

)

|

|

|

(2,160

|

)

|

|

|

4,569

|

|

|

Adjusted Net Income (Loss)

|

$

|

(8,044

|

)

|

|

$

|

(1,591

|

)

|

|

$

|

(15,848

|

)

|

|

$

|

(22,474

|

)

|

|

$

|

8,752

|

|

|

Adjusted Net Income (Loss) per common share—

|

|

|

|

|

|

|

|

|

|

|

|

– Basic

|

$

|

(0.21

|

)

|

|

$

|

(0.04

|

)

|

|

$

|

(0.36

|

)

|

|

$

|

(0.55

|

)

|

|

$

|

0.20

|

|

|

– Diluted

|

$

|

(0.21

|

)

|

|

$

|

(0.04

|

)

|

|

$

|

(0.36

|

)

|

|

$

|

(0.55

|

)

|

|

$

|

0.19

|

|

|

Weighted average number of shares – basic

|

|

38,834,451

|

|

|

|

40,145,290

|

|

|

|

44,054,275

|

|

|

|

41,013,069

|

|

|

|

44,850,791

|

|

|

Weighted average number of shares – diluted

|

|

38,834,451

|

|

|

|

40,145,290

|

|

|

|

44,054,275

|

|

|

|

41,013,069

|

|

|

|

45,795,559

|

|

We present Adjusted EBITDA and Adjusted Net Income (Loss) as supplemental measures of our performance. We define Adjusted EBITDA for the periods indicated as EBITDA (as defined below), adjusted to exclude (i) Equity-based compensation expense, (ii) Foreign currency loss (gain), net, (iii) Derivative valuation loss (gain), net and (iv) Early termination and other charges, net. EBITDA for the periods indicated is defined as net income (loss) before interest income, interest expense, income tax expense (benefit) and depreciation and amortization.

We prepare Adjusted Net Income (Loss) by adjusting net income (loss) to eliminate the impact of a number of non-cash expenses and other items that may be either one time or recurring that we do not consider to be indicative of our core ongoing operating performance. We believe that Adjusted Net Income (Loss) is particularly useful because it reflects the impact of our asset base and capital structure on our operating performance. We define Adjusted Net Income (Loss) for the periods as net income (loss), adjusted to exclude (i) Equity-based compensation expense, (ii) Foreign currency loss (gain), net, (iii) Derivative valuation loss (gain), net, (iv) Early termination and other charges, net and (v) Income tax effect on non-GAAP adjustments.

For the year ended December 31, 2023, Early termination and other charges includes $8,449 thousand of termination related charges in connection with the voluntary resignation program that we offered to certain employees during the first quarter of 2023 and $802 thousand of one-time employee incentives.

For the year ended December 31, 2022, Early termination and other charges, net includes $2,821 thousand of one-time employee incentives and professional service fees and expenses of $1,014 thousand, incurred in connection with certain strategic evaluations, both of which were offset in part by a $537 thousand gain on sale of certain legacy equipment of the closed back-end line in our fabrication facility in Gumi.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240228959831/en/

Steven Pelayo

The Blueshirt Group

Tel. +1 (360) 808-5154

steven@blueshirtgroup.co

Source: Magnachip Semiconductor Corporation

Magnachip Celebrates the Grand Opening of Magnachip Technology Company in China

Magnachip Celebrates the Grand Opening of Magnachip Technology Company in China