- Revenue of $61.2 million was in-line with guidance.

- Gross profit margin of 23.6% increased 140 basis points from Q2, mainly driven by higher fab utilization.

- GAAP diluted loss per share was $0.13.

- Non-GAAP diluted loss per share was $0.04.

- Completed $5.4 million of stock buybacks during Q3.

- Ended Q3 with a solid balance sheet with $166.6 million cash and no debt.

- The internal separation of our Display and Power businesses is expected to be completed and be effective on January 1st, 2024.

SEOUL, South Korea, Nov. 2, 2023 /PRNewswire/ — Magnachip Semiconductor Corporation (NYSE: MX) (“Magnachip” or the “Company”) today announced financial results for the third quarter 2023.![]() YJ Kim, Magnachip’s Chief Executive Officer commented, “Our Q3 results were in-line with our guidance. In our Display business, we have completed the qualification of two DDI chips at our new tier 1 panel maker and are going through the qualification process with two smartphone makers. We are now working on additional Driver ICs that cover broader segments of the smartphone market to include mass market smartphones in addition to the premium models. Despite near-term market challenges, our outlook for long-term growth remains positive. Our confidence is driven by our strong belief that our display products offer distinct competitive advantages that position us well for success in the rapidly growing OLED market in Asia.”

YJ Kim, Magnachip’s Chief Executive Officer commented, “Our Q3 results were in-line with our guidance. In our Display business, we have completed the qualification of two DDI chips at our new tier 1 panel maker and are going through the qualification process with two smartphone makers. We are now working on additional Driver ICs that cover broader segments of the smartphone market to include mass market smartphones in addition to the premium models. Despite near-term market challenges, our outlook for long-term growth remains positive. Our confidence is driven by our strong belief that our display products offer distinct competitive advantages that position us well for success in the rapidly growing OLED market in Asia.”

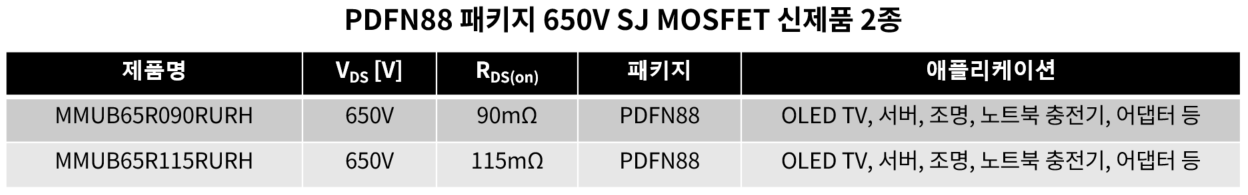

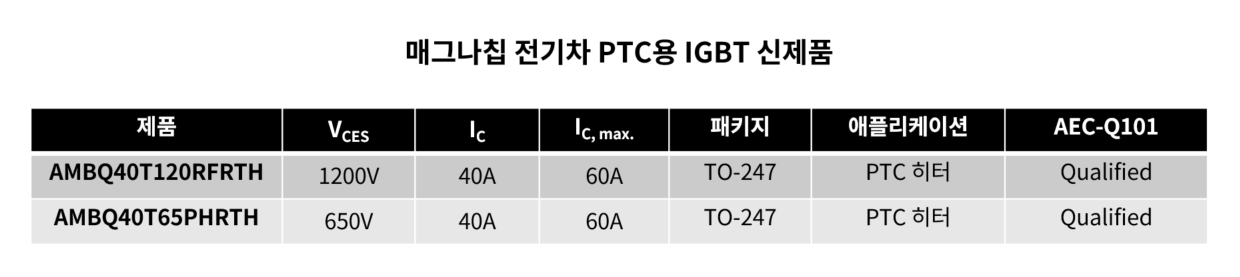

YJ continued, “In our Power business, our product portfolio is getting stronger as we continue to focus on rolling out next-generation power products to maintain our momentum of design-in/wins. Looking ahead, amid heightened global geopolitical and macroeconomic uncertainty, we expect demand to remain soft, driven by normal Q4 seasonality and inventory correction in industrial end markets.”

| Q3 2023 Financial Highlights | ||||||||||||||||||||||||||||

| In thousands of U.S. dollars, except share data | ||||||||||||||||||||||||||||

| GAAP | ||||||||||||||||||||||||||||

| Q3 2023 | Q2 2023 | Q/Q change | Q3 2022 | Y/Y change | ||||||||||||||||||||||||

| Revenues | ||||||||||||||||||||||||||||

| Standard Products Business | ||||||||||||||||||||||||||||

| Display Solutions | 6,404 | 9,657 | down | 33.7 | % | 6,355 | up | 0.8 | % | |||||||||||||||||||

| Power Solutions | 45,215 | 41,718 | up | 8.4 | % | 56,416 | down | 19.9 | % | |||||||||||||||||||

| Transitional Fab 3 foundry services(1) | 9,626 | 9,604 | up | 0.2 | % | 8,428 | up | 14.2 | % | |||||||||||||||||||

| Gross Profit Margin | 23.6 | % | 22.2 | % | up | 1.4 | %pts | 24.2 | % | down | 0.6 | %pts | ||||||||||||||||

| Operating Loss | (9,235) | (10,656) | up | n/a | (10,008) | up | n/a | |||||||||||||||||||||

| Net Loss | (5,165) | (3,947) | down | n/a | (17,195) | up | n/a | |||||||||||||||||||||

| Basic Loss per Common Share | (0.13) | (0.09) | down | n/a | (0.38) | up | n/a | |||||||||||||||||||||

| Diluted Loss per Common Share | (0.13) | (0.09) | down | n/a | (0.38) | up | n/a | |||||||||||||||||||||

| In thousands of U.S. dollars, except share data | ||||||||||||||||||||||||||||

| Non-GAAP(2) | ||||||||||||||||||||||||||||

| Q3 2023 | Q2 2023 | Q/Q change | Q3 2022 | Y/Y change | ||||||||||||||||||||||||

| Adjusted Operating Loss | (7,064) | (7,762) | up | n/a | (6,646) | down | n/a | |||||||||||||||||||||

| Adjusted EBITDA | (2,735) | (3,594) | up | n/a | (2,995) | up | n/a | |||||||||||||||||||||

| Adjusted Net Income (Loss) | (1,591) | (2,472) | up | n/a | 1,097 | down | n/a | |||||||||||||||||||||

| Adjusted Earnings (Loss) per Common Share—Diluted | (0.04) | (0.06) | up | n/a | 0.02 | down | n/a | |||||||||||||||||||||

| ___________ | |

| (1) | Following the consummation of the sale of the Foundry Services Group business and Fab 4 in Q3 2020, we provided transitional foundry services to the buyer for foundry products manufactured in our fabrication facility located in Gumi, Korea, known as “Fab 3” (“Transitional Fab 3 Foundry Services”). The contractual obligation to provide the Transitional Fab 3 Foundry Services ended August 31, 2023, and we are planning to wind down these foundry services and convert portions of the idle capacity to Power Solutions standard products beginning around the second half of 2024. Because these foundry services during the wind-down period are still provided to the same buyer by us using our Fab 3 based on mutually agreed terms and conditions, we will continue to report our revenue from providing these foundry services and related cost of sales within the Transitional Fab 3 Foundry Services line in our consolidated statement of operations until such wind down is completed. Management believes that disclosing revenue of Transitional Fab 3 Foundry Services separately from the standard products business allows investors to better understand the results of our core standard products display solutions and power solutions businesses. |

| (2) | Management believes that non-GAAP financial measures, when viewed in conjunction with GAAP results, can provide a meaningful understanding of the factors and trends affecting our business and operations and assist in evaluating our core operating performance. However, such non-GAAP financial measures have limitations and should not be considered as a substitute for net income (loss) or as a better indicator of our operating performance than measures that are presented in accordance with GAAP. A reconciliation of GAAP results to non-GAAP results is included in this press release. |

Q4 2023 Financial Guidance

Amid heightened global geopolitical and macroeconomic uncertainty, we expect Power demand to soften driven by normal Q4 seasonality and inventory correction in industrial end markets.

While actual results may vary, Magnachip currently expects the following for Q4 2023:

- Revenue to be in the range of $50 million to $55 million, including approximately $8 million of Transitional Fab 3 Foundry Services.

- Gross profit margin to be in the range of 22.5% to 24.5%.

Q3 2023 Earnings Conference Call

Magnachip will host a corresponding conference call at 2:00 p.m. PT / 5:00 p.m. ET on Thursday, November 2, 2023, to discuss its financial results. In advance of the conference call, all participants must use the following link to complete the online registration process. Upon registering, each participant will receive access details for this event including the dial-in numbers, a PIN number, and an e-mail with detailed instructions to join the conference call. A live and archived webcast of the conference call and a copy of earnings release will be accessible from the ‘Investors’ section of the Company’s website at www.magnachip.com/kr.

Online registration: https://register.vevent.com/register/BI9578e24ef24a498a8d8ee6536b08edc6

Safe Harbor for Forward-Looking Statements

Information in this release regarding Magnachip’s forecasts, business outlook, expectations and beliefs are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. These statements include expectations about estimated historical or future operating results and financial performance, outlook and business plans, including fourth quarter 2023 revenue and gross profit margin expectations, and the impact of market conditions associated with inflation and higher interest rates, remaining effects from the COVID-19 pandemic, geopolitical conflicts between Russia- Ukraine and between Israel-Hamas, escalated trade tensions between the U.S. and China and continuing supply constraints on Magnachip’s fourth quarter 2023 and future operating results. All forward-looking statements included in this release are based upon information available to Magnachip as of the date of this release, which may change, and we assume no obligation to update any such forward-looking statements. These statements are not guarantees of future performance and actual results could differ materially from our current expectations. Factors that could cause or contribute to such differences include, among others: the impact of changes in macroeconomic conditions, including those caused by or related to inflation, potential recessions or other deteriorations, economic instability or civil unrest; remaining effects from the COVID-19 pandemic, the geopolitical conflicts between Russia-Ukraine and between Israel-Hamas, and escalated trade tensions between the U.S. and China; manufacturing capacity constraints or supply chain disruptions that may impact our ability to deliver our products or affect the price of components, which may lead to an increase in our costs and impact demand for our products from customers who are similarly affected by such capacity constraints or disruptions; the impact of competitive products and pricing; timely acceptance of our designs by customers; timely introduction of new products and technologies; our ability to ramp new products into volume production; industry-wide shifts in supply and demand for semiconductor products; overcapacity within the industry or at Magnachip; effective and cost-efficient utilization of manufacturing capacity; financial stability in foreign markets and the impact of foreign exchange rates; unanticipated costs and expenses or the inability to identify expenses that can be eliminated; compliance with U.S. and international trade and export laws and regulations by us, our customers and our distributors; change to or ratification of local or international laws and regulations, including those related to environment, health and safety; public health issues, including the remaining effects of the COVID-19 pandemic; other business interruptions that could disrupt supply or delivery of, or demand for, Magnachip’s products; and other risks detailed from time to time in Magnachip’s filings with the U.S. Securities and Exchange Commission (the “SEC”), including our Form 10-K filed on February 22, 2023, and subsequent registration statements, amendments or other reports that we may file from time to time with the SEC and/or make available on our website. Magnachip assumes no obligation and does not intend to update the forward-looking statements provided, whether as a result of new information, future events or otherwise.

About Magnachip Semiconductor

Magnachip is a designer and manufacturer of analog and mixed-signal semiconductor platform solutions for communications, IoT, consumer, computing, industrial and automotive applications. The Company provides a broad range of standard products to customers worldwide. Magnachip, with more than 40 years of operating history, owns a portfolio of approximately 1,100 registered patents and pending applications, and has extensive engineering, design, and manufacturing process expertise. For more information, please visit www.magnachip.com/kr. Information on or accessible through Magnachip’s website is not a part of, and is not incorporated into, this release.

CONTACT:

Yujia Zhai

The Blueshirt Group

Tel. (860) 214-0809

Yujia@blueshirtgroup.com

| MAGNACHIP SEMICONDUCTOR CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands of U.S. dollars, except share data) (Unaudited) |

|||||||||

| Three Months Ended | Nine Months Ended | ||||||||

| September 30, 2023 |

June 30, 2023 |

September 30, 2022 |

September 30, 2023 |

September 30, 2022 |

|||||

| Revenues: | |||||||||

| Net sales – standard products business | $ 51,619 | $ 51,375 | $ 62,771 | $ 154,508 | $ 248,069 | ||||

| Net sales – transitional Fab 3 foundry services | 9,626 | 9,604 | 8,428 | 24,721 | 28,599 | ||||

| Total revenues | 61,245 | 60,979 | 71,199 | 179,229 | 276,668 | ||||

| Cost of sales: | |||||||||

| Cost of sales – standard products business | 36,829 | 37,867 | 45,497 | 112,008 | 165,197 | ||||

| Cost of sales – transitional Fab 3 foundry services | 9,935 | 9,574 | 8,477 | 27,108 | 26,305 | ||||

| Total cost of sales | 46,764 | 47,441 | 53,974 | 139,116 | 191,502 | ||||

| Gross profit | 14,481 | 13,538 | 17,225 | 40,113 | 85,166 | ||||

| Gross profit as a percentage of standard products business net sales | 28.7 % | 26.3 % | 27.5 % | 27.5 % | 33.4 % | ||||

| Gross profit as a percentage of total revenues | 23.6 % | 22.2 % | 24.2 % | 22.4 % | 30.8 % | ||||

| Operating expenses: | |||||||||

| Selling, general and administrative expenses | 12,089 | 12,137 | 11,411 | 36,391 | 38,310 | ||||

| Research and development expenses | 11,627 | 11,255 | 13,321 | 36,180 | 38,685 | ||||

| Early termination and other charges, net | — | 802 | 2,501 | 9,251 | 3,298 | ||||

| Total operating expenses | 23,716 | 24,194 | 27,233 | 81,822 | 80,293 | ||||

| Operating income (loss) | (9,235) | (10,656) | (10,008) | (41,709) | 4,873 | ||||

| Interest income | 2,382 | 2,692 | 1,784 | 7,916 | 3,560 | ||||

| Interest expense | (189) | (200) | (278) | (645) | (888) | ||||

| Foreign currency gain (loss), net | (2,583) | 1,237 | (12,809) | (4,776) | (20,511) | ||||

| Other income, net | 87 | 3 | 174 | 55 | 603 | ||||

| Loss before income tax expense | (9,538) | (6,924) | (21,137) | (39,159) | (12,363) | ||||

| Income tax benefit | (4,373) | (2,977) | (3,942) | (8,577) | (1,356) | ||||

| Net loss | $ (5,165) | $ (3,947) | $ (17,195) | $ (30,582) | $ (11,007) | ||||

| Basic loss per common share— | $ (0.13) | $ (0.09) | $ (0.38) | $ (0.73) | $ (0.24) | ||||

| Diluted loss per common share— | $ (0.13) | $ (0.09) | $ (0.38) | $ (0.73) | $ (0.24) | ||||

| Weighted average number of shares— | |||||||||

| Basic | 40,145,290 | 41,741,310 | 44,865,266 | 41,747,255 | 45,119,214 | ||||

| Diluted | 40,145,290 | 41,741,310 | 44,865,266 | 41,747,255 | 45,119,214 | ||||

| MAGNACHIP SEMICONDUCTOR CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS (In thousands of U.S. dollars, except share data) (Unaudited) |

||||||

| September 30,

2023 |

December 31,

2022 |

|||||

| Assets | ||||||

| Current assets | ||||||

| Cash and cash equivalents | $ 166,644 | $ 225,477 | ||||

| Accounts receivable, net | 41,119 | 35,380 | ||||

| Inventories, net | 30,836 | 39,883 | ||||

| Other receivables | 2,799 | 7,847 | ||||

| Prepaid expenses | 9,095 | 10,560 | ||||

| Hedge collateral | 2,680 | 2,940 | ||||

| Other current assets | 24,572 | 15,766 | ||||

| Total current assets | 277,745 | 337,853 | ||||

| Property, plant and equipment, net | 96,141 | 110,747 | ||||

| Operating lease right-of-use assets | 4,725 | 5,265 | ||||

| Intangible assets, net | 1,583 | 1,930 | ||||

| Long-term prepaid expenses | 6,124 | 10,939 | ||||

| Deferred income taxes | 36,358 | 38,324 | ||||

| Other non-current assets | 11,622 | 11,587 | ||||

| Total assets | $ 434,298 | $ 516,645 | ||||

| Liabilities and Stockholders’ Equity | ||||||

| Current liabilities | ||||||

| Accounts payable | $ 23,446 | $ 17,998 | ||||

| Other accounts payable | 8,025 | 9,702 | ||||

| Accrued expenses | 9,668 | 9,688 | ||||

| Accrued income taxes | 48 | 3,154 | ||||

| Operating lease liabilities | 1,735 | 1,397 | ||||

| Other current liabilities | 4,495 | 5,306 | ||||

| Total current liabilities | 47,417 | 47,245 | ||||

| Accrued severance benefits, net | 20,160 | 23,121 | ||||

| Non-current operating lease liabilities | 3,167 | 4,091 | ||||

| Other non-current liabilities | 9,862 | 14,035 | ||||

| Total liabilities | 80,606 | 88,492 | ||||

| Commitments and contingencies | ||||||

| Stockholders’ equity | ||||||

| Common stock, $0.01 par value, 150,000,000 shares authorized, 56,655,377 shares issued and 39,667,995 outstanding at September 30, 2023 and 56,432,449 shares issued and 43,824,575 outstanding at December 31, 2022 |

566 | 564 | ||||

| Additional paid-in capital | 271,419 | 266,058 | ||||

| Retained earnings | 304,924 | 335,506 | ||||

| Treasury stock, 16,987,382 shares at September 30, 2023 and 12,607,874 shares at December 31, 2022, respectively |

(204,645) | (161,422) | ||||

| Accumulated other comprehensive loss | (18,572) | (12,553) | ||||

| Total stockholders’ equity | 353,692 | 428,153 | ||||

| Total liabilities and stockholders’ equity | $ 434,298 | $ 516,645 | ||||

| MAGNACHIP SEMICONDUCTOR CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands of U.S. dollars) (Unaudited) |

||||||||||||||

| Three Months

Ended |

Nine Months Ended |

|||||||||||||

| September 30, 2023 |

September 30, 2023 |

September 30, 2022 |

||||||||||||

| Cash flows from operating activities | ||||||||||||||

| Net loss | $ (5,165) | $ (30,582) | $ (11,007) | |||||||||||

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities | ||||||||||||||

| Depreciation and amortization | 4,081 | 12,583 | 11,225 | |||||||||||

| Provision for severance benefits | 1,267 | 5,358 | 5,163 | |||||||||||

| Loss on foreign currency, net | 5,415 | 14,532 | 66,335 | |||||||||||

| Provision for inventory reserves | 1,914 | 3,035 | 7,730 | |||||||||||

| Stock-based compensation | 2,171 | 5,383 | 4,487 | |||||||||||

| Other, net | 230 | 680 | 631 | |||||||||||

| Changes in operating assets and liabilities | ||||||||||||||

| Accounts receivable, net | (6,067) | (6,409) | 7,805 | |||||||||||

| Inventories | (1,276) | 3,635 | (13,208) | |||||||||||

| Other receivables | 586 | 4,993 | 17,115 | |||||||||||

| Other current assets | (2,686) | (2,291) | (14,117) | |||||||||||

| Accounts payable | 3,186 | 6,066 | (14,792) | |||||||||||

| Other accounts payable | (250) | (6,738) | (6,215) | |||||||||||

| Accrued expenses | (485) | 619 | 5,866 | |||||||||||

| Accrued income taxes | (42) | (3,014) | (11,483) | |||||||||||

| Other current liabilities | (270) | (741) | (1,583) | |||||||||||

| Other non-current liabilities | (65) | (279) | 523 | |||||||||||

| Payment of severance benefits | (455) | (6,183) | (4,181) | |||||||||||

| Other, net | (354) | (841) | (50) | |||||||||||

| Net cash provided by (used in) operating activities | 1,735 | (194) | 50,244 | |||||||||||

| Cash flows from investing activities | ||||||||||||||

| Proceeds from settlement of hedge collateral | — | 3,335 | 2,805 | |||||||||||

| Payment of hedge collateral | (568) | (3,154) | (15,282) | |||||||||||

| Purchase of property, plant and equipment | (762) | (2,280) | (11,812) | |||||||||||

| Payment for intellectual property registration | (67) | (230) | (301) | |||||||||||

| Collection of guarantee deposits | 3,539 | 4,984 | 242 | |||||||||||

| Payment of guarantee deposits | (369) | (7,276) | (2,075) | |||||||||||

| Other | — | — | 550 | |||||||||||

| Net cash provided by (used in) investing activities | 1,773 | (4,621) | (25,873) | |||||||||||

| Cash flows from financing activities | ||||||||||||||

| Proceeds from exercise of stock options | — | 27 | 1,786 | |||||||||||

| Acquisition of treasury stock | (6,247) | (43,087) | (5,065) | |||||||||||

| Repayment of financing related to water treatment facility arrangement | (123) | (371) | (381) | |||||||||||

| Repayment of principal portion of finance lease liabilities | (23) | (69) | (50) | |||||||||||

| Net cash used in financing activities | (6,393) | (43,500) | (3,710) | |||||||||||

| Effect of exchange rates on cash and cash equivalents | (3,425) | (10,518) | (49,377) | |||||||||||

| Net decrease in cash and cash equivalents | (6,310 ) | (58,833) | (28,716) | |||||||||||

| Cash and cash equivalents | ||||||||||||||

| Beginning of the period | 172,954 | 225,477 | 279,547 | |||||||||||

| End of the period | $ 166,644 | $ 166,644 | $ 250,831 | |||||||||||

| MAGNACHIP SEMICONDUCTOR CORPORATION AND SUBSIDIARIES

RECONCILIATION OF OPERATING INCOME (LOSS) TO ADJUSTED OPERATING INCOME (LOSS) (In thousands of U.S. dollars) (Unaudited) |

|||||||||||||||||||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||||||||||

| September 30, 2023 |

June 30, 2023 |

September 30, 2022 |

September 30, 2023 |

September 30, 2022 |

|||||||||||||||||||||||||||

| Operating income (loss) | $ | (9,235) | $ | (10,656) | $ | (10,008) | $ | (41,709) | $ | 4,873 | |||||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||||

| Equity-based compensation expense | 2,171 | 2,092 | 861 | 5,383 | 4,487 | ||||||||||||||||||||||||||

| Early termination and other charges, net | — | 802 | 2,501 | 9,251 | 3,298 | ||||||||||||||||||||||||||

| Adjusted Operating Income (Loss) | $ | (7,064) | $ | (7,762) | $ | (6,646) | $ | (27,075) | $ | 12,658 | |||||||||||||||||||||

We present Adjusted Operating Income (Loss) as a supplemental measure of our performance. We define Adjusted Operating Income (Loss) for the periods indicated as operating income (loss) adjusted to exclude (i) Equity-based compensation expense and (ii) Early termination and other charges, net.

For the nine months ended September 30, 2023, we recorded in our consolidated statement of operations $8,449 thousand of termination related charges in connection with the voluntary resignation program that we offered to certain employees during the first quarter of 2023. For the three months ended June 30, 2023 and nine months ended September 30, 2023, we recorded $802 thousand of one-time employee incentives, in each period.

For the three and nine months ended September 30, 2022, Early termination and other charges, net includes $2,821 thousand of one-time employee incentives, in each period, and professional service fees and expenses of $217 thousand and $1,014 thousand, respectively, incurred in connection with certain strategic evaluations, both of which were offset in part by a $537 thousand gain on sale of certain legacy equipment of the closed back-end line in our fabrication facility in Gumi.

| MAGNACHIP SEMICONDUCTOR CORPORATION AND SUBSIDIARIES

RECONCILIATION OF NET LOSS TO ADJUSTED EBITDA AND ADJUSTED NET INCOME (LOSS) (In thousands of U.S. dollars, except share data) (Unaudited) |

|||||||||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||

| September 30, 2023 |

June 30, 2023 |

September 30, 2022 |

September 30, 2023 |

September 30, 2022 |

|||||||||||||||||

| Net loss | $ (5,165) | $ (3,947) | $ (17,195) | $ (30,582) | $ (11,007) | ||||||||||||||||

| Adjustments: | |||||||||||||||||||||

| Interest income | (2,382) | (2,692) | (1,784) | (7,916) | (3,560) | ||||||||||||||||

| Interest expense | 189 | 200 | 278 | 645 | 888 | ||||||||||||||||

| Income tax benefit | (4,373) | (2,977) | (3,942) | (8,577) | (1,356) | ||||||||||||||||

| Depreciation and amortization | 4,081 | 4,145 | 3,623 | 12,583 | 11,225 | ||||||||||||||||

| EBITDA | (7,650) | (5,271) | (19,020 ) | (33,847) | (3,810) | ||||||||||||||||

| Equity-based compensation expense | 2,171 | 2,092 | 861 | 5,383 | 4,487 | ||||||||||||||||

| Foreign currency loss (gain), net | 2,583 | (1,237) | 12,809 | 4,776 | 20,511 | ||||||||||||||||

| Derivative valuation loss (gain), net | 161 | 20 | (146) | 235 | (201) | ||||||||||||||||

| Early termination and other charges, net | — | 802 | 2,501 | 9,251 | 3,298 | ||||||||||||||||

| Adjusted EBITDA | $ (2,735) | $ (3,594) | $ (2,995) | $ (14,202) | $ 24,285 | ||||||||||||||||

| Net loss | $ (5,165) | $ (3,947) | $ (17,195) | $ (30,582) | $ (11,007) | ||||||||||||||||

| Adjustments: | |||||||||||||||||||||

| Equity-based compensation expense | 2,171 | 2,092 | 861 | 5,383 | 4,487 | ||||||||||||||||

| Foreign currency loss (gain), net | 2,583 | (1,237) | 12,809 | 4,776 | 20,511 | ||||||||||||||||

| Derivative valuation loss (gain), net | 161 | 20 | (146) | 235 | (201) | ||||||||||||||||

| Early termination and other charges, net | — | 802 | 2,501 | 9,251 | 3,298 | ||||||||||||||||

| Income tax effect on non-GAAP adjustments | (1,341) | (202) | 2,267 | (3,493) | 7,512 | ||||||||||||||||

| Adjusted Net Income (Loss) | $ (1,591) | $ (2,472) | $ 1,097 | $ (14,430) | $ 24,600 | ||||||||||||||||

| Adjusted Net Income (Loss) per common share— | |||||||||||||||||||||

| – Basic | $ (0.04) | $ (0.06) | $ 0.02 | $ (0.35) | $ 0.55 | ||||||||||||||||

| – Diluted | $ (0.04) | $ (0.06) | $ 0.02 | $ (0.35) | $ 0.53 | ||||||||||||||||

| Weighted average number of shares – basic | 40,145,290 | 41,741,310 | 44,865,266 | 41,747,255 | 45,119,214 | ||||||||||||||||

| Weighted average number of shares – diluted | 40,145,290 | 41,741,310 | 45,747,255 | 41,747,255 | 46,134,231 | ||||||||||||||||

We present Adjusted EBITDA and Adjusted Net Income (Loss) as supplemental measures of our performance. We define Adjusted EBITDA for the periods indicated as EBITDA (as defined below), adjusted to exclude (i) Equity-based compensation expense, (ii) Foreign currency loss (gain), net, (iii) Derivative valuation loss (gain), net and (iv) Early termination and other charges, net. EBITDA for the periods indicated is defined as net loss before interest income, interest expense, income tax benefit and depreciation and amortization.

We prepare Adjusted Net Income (Loss) by adjusting net loss to eliminate the impact of a number of non-cash expenses and other items that may be either one time or recurring that we do not consider to be indicative of our core ongoing operating performance. We believe that Adjusted Net Income (Loss) is particularly useful because it reflects the impact of our asset base and capital structure on our operating performance. We define Adjusted Net Income (Loss) for the periods as net loss, adjusted to exclude (i) Equity-based compensation expense, (ii) Foreign currency loss (gain), net, (iii) Derivative valuation loss (gain), net, (iv) Early termination and other charges, net and (v) Income tax effect on non-GAAP adjustments.

For the nine months ended September 30, 2023, we recorded in our consolidated statement of operations $8,449 thousand of termination related charges in connection with the voluntary resignation program that we offered to certain employees during the first quarter of 2023. For the three months ended June 30, 2023 and nine months ended September 30, 2023, we recorded $802 thousand of one-time employee incentives, in each period.

For the three and nine months ended September 30, 2022, Early termination and other charges, net includes $2,821 thousand of one-time employee incentives, in each period, and professional service fees and expenses of $217 thousand and $1,014 thousand, respectively, incurred in connection with certain strategic evaluations, both of which were offset in part by a $537 thousand gain on sale of certain legacy equipment of the closed back-end line in our fabrication facility in Gumi.

View original content to download multimedia:https://www.prnewswire.com/news-releases/magnachip-reports-results-for-third-quarter-2023-301976238.html

SOURCE Magnachip Semiconductor Corporation