– Transaction Value Approximately $435 Million, Including $345 Million in Cash –

– Streamlines MagnaChip into a Pure-play Standard Products Company –

– Positions the Company to Focus on High Growth Markets in Analog Power and Display Solutions Including OLED and MicroLED –

– Strengthens MagnaChip’s Balance Sheet Significantly as Company Intends to Use the Proceeds to Reduce Debt –

SEOUL, South Korea, March 30, 2020 /PRNewswire/ — MagnaChip Semiconductor Corporation (“MagnaChip” or the “Company”) (NYSE: MX) today announced that certain of its wholly-owned subsidiaries have entered into a definitive agreement (the “Agreement”) to sell the Company’s Foundry Services Group and the factory in Cheongju (“Fab 4″), the larger of the Company’s two 8” manufacturing facilities (collectively, the “Target Business”), to a special purpose company (the “SPC”) in South Korea established by Alchemist Capital Partners Korea Co., Ltd. (“Alchemist”) and Credian Partners, Inc. (“Credian”, and together with Alchemist, “AC Consortium”).

Under the terms of the Agreement, the total transaction value is approximately $435 million, consisting of the South Korean won equivalent of $344.7 million in cash based on the exchange rate on the third business day prior to the closing date of the transaction and the SPC’s assumption of statutory severance liabilities attributable to the employees who will be transferred together with the Target Business, which is currently estimated to be approximately $90 million (subject to the then-effective exchange rate). The cash purchase price is subject to a customary working capital adjustment. MagnaChip anticipates it will use net operating loss carryforwards to offset a portion of the tax obligations related to this transaction. Moreover, the Company intends to use the net proceeds from the transaction to significantly reduce debt and strengthen its balance sheet. Taken together, the transaction-related tax exposure is estimated to be up to 15% of the net cash proceeds from the transaction.

MagnaChip’s Chief Executive Officer, YJ Kim, said: “This is an excellent outcome for all our stakeholders, including customers, employees and investors. Importantly, it will allow us to meaningfully improve our balance sheet, and fully focus as a pure-play standard products company on the attractive high-growth opportunities in our Display Solutions and Power Solutions business lines. We look forward to building upon our leadership position in the OLED display driver business and are excited about the emerging MicroLED space. Our Power products portfolio, including Premium Power products, are aligned with the needs of a broad range of markets, and are ideally suited to serve the requirements of the Electric Vehicle segment of the auto market. Finally, we are confident there will also be myriad benefits for the Foundry business and its employees, who will have significant new opportunities as a result of the transaction.”

Under the terms of the Agreement, the SPC will acquire the Target Business. Alchemist and Credian serve as joint general partners of a project fund that established the SPC, while its limited partners consist of SK hynix Inc., one of the largest semiconductor companies in the world, and Korean Federation of Community Credit Cooperatives. Upon the closing of the transaction, approximately 1,500 MagnaChip employees are expected to be transferred to the SPC, which would result in SPC assuming approximately $90 million (subject to the then-effective exchange rate) in statutory severance liabilities recorded on MagnaChip’s balance sheet. The Agreement is subject to customary closing conditions.

“After conducting a thorough strategic evaluation process of the Foundry business and Fab 4, the Board of Directors and management team concluded that this transaction was the best option to maximize value for our shareholders,” said Nader Tavakoli, Chairman of the Board of MagnaChip.

“Following the completion of this sale, MagnaChip will be streamlined operationally, largely freed of interest expense and we believe will be ideally positioned for continued future success.”

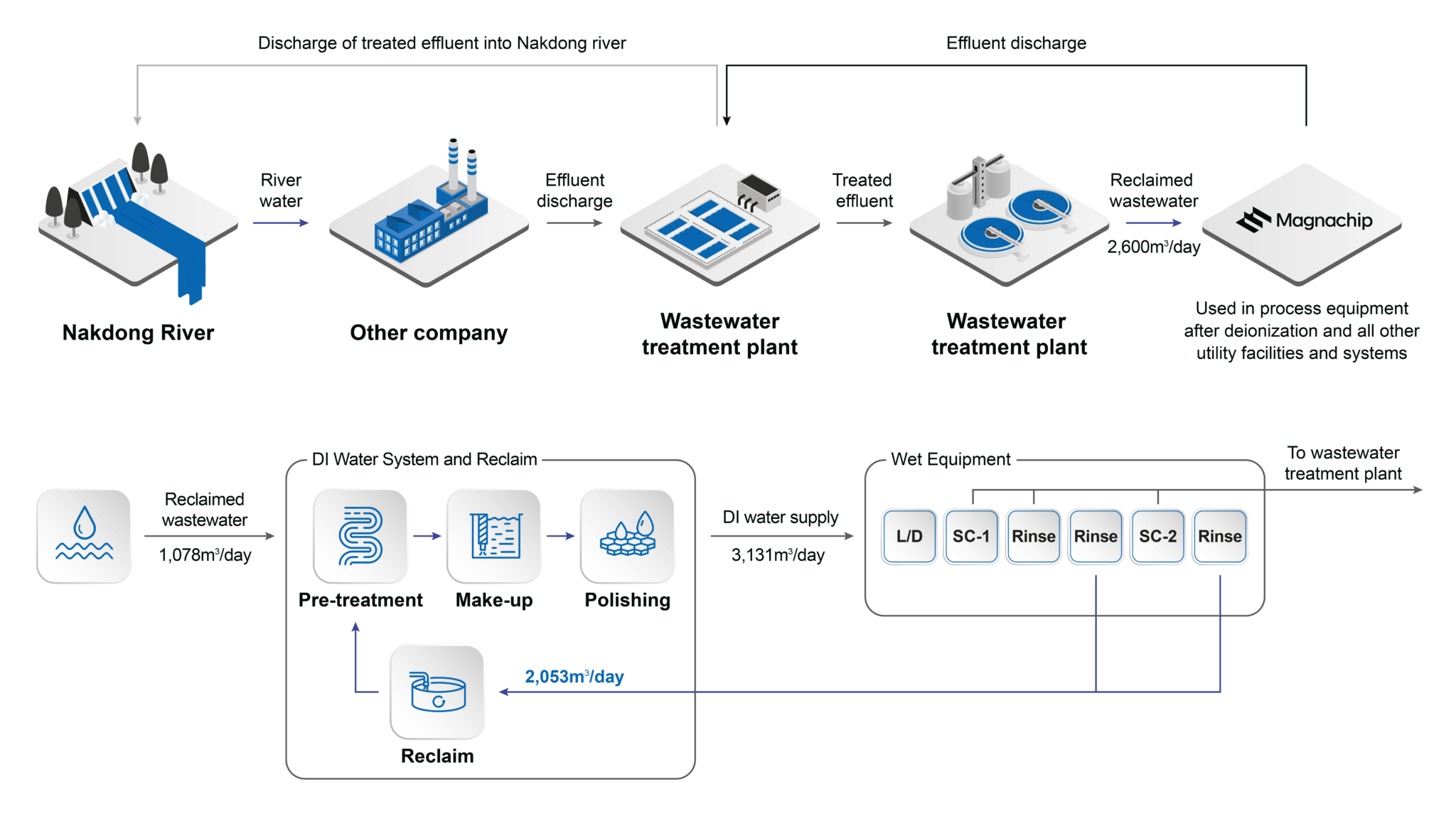

MagnaChip is the largest independent supplier of organic light emitting diodes (OLED) display driver integrated circuits (DDICs) to the world’s top two panel manufacturers for smartphones. The Company’s large portfolio of OLED DDICs includes multiple 28-nanometer display drivers with the industry’s lowest power, a key requirement for smartphones, including upcoming 5G and foldable models. The Company’s Power Solutions business is a leading provider of standard products, including battery field effect transistors (FETS) to increase power efficiency in smartphone batteries, as well as premium products such as super junction metal oxide semiconductor field effect transistors (MOSFETs), insulated-gate bipolar transistors (IGBTs) and power integrated circuits for consumer, TV, communications and industrial applications. The Company will continue to operate its Power Discrete 8″ fab (Fab 3, located in Gumi, Korea) used primarily to manufacture wafers for Power standard products and non-OLED display products.

Approvals

The transaction is expected to close within approximately four to six months, subject to customary closing conditions.

Advisors

J.P. Morgan Securities LLC served as financial advisor and Paul, Weiss, Rifkind, Wharton & Garrison LLP and Kim & Chang served as legal counsel to MagnaChip. Samsung Securities Co., Ltd. served as financial advisor, Lee & Ko and KL Partners served as legal counsel and Samjong KPMG served as accounting advisor to the AC Consortium.

MagnaChip to Host a Conference Call on Tuesday, March 31 at 9 am ET

The conference call will be webcast live on Tuesday, March 31, 2020 at 9:00 a.m. ET, and is available by dialing toll-free at 1-844-413-0952. International call-in participants can dial 1-216-562-0462. The conference ID number is 3388826. Participants are encouraged to initiate their calls at least 10 minutes in advance of the 9 a.m. ET start time to ensure a timely connection. The webcast and press release will be accessible at www.magnachip.com. A replay of the conference call will be available the same day and will run for 72 hours. The replay dial-in numbers are 1-404-537-3406 or toll-free at 1-855-859-2056. The access code is 3388826.

About MagnaChip Semiconductor Corporation

MagnaChip is a designer and manufacturer of analog and mixed-signal semiconductor platform solutions for communications, IoT, consumer, industrial and automotive applications. The Company’s Standard Products Group and Foundry Services Group provide a broad range of standard products and manufacturing services to customers worldwide. MagnaChip, with more than 40 years of operating history, owns a portfolio of approximately 2,950 registered patents and pending applications, and has extensive engineering, design and manufacturing process expertise. For more information, please visit www.magnachip.com. Information on or accessible through, MagnaChip’s website is not a part of, and is not incorporated into, this release.

Safe Harbor for Forward-Looking Statements

Information in this release regarding the Company’s forecasts, business outlook, expectations and beliefs are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. All forward-looking statements included in this release are based upon information available to the Company as of the date of this release, which may change, and we assume no obligation to update any such forward-looking statements. These statements are not guarantees of future performance and actual results could differ materially from our current expectations. A number of important factors could cause actual results to differ materially from those indicated in such forward-looking statements. These factors include, but are not limited to, (i) the risk that the transaction may not be completed in a timely manner or at all, (ii) the possibility that any or all of the various conditions to the consummation of the transaction may not be satisfied or waived, (iii) the occurrence of any event, change or circumstance that could give rise to the termination of the Agreement, (iv) the effect of the announcement or pendency of the transaction on the Company’s ability to retain and hire key personnel, its ability to maintain relationships with its customers, suppliers and others with whom it does business, or its operating results and business generally, (v) the risk that revenues following the transaction may be lower than expected, (vi) the risk that operating costs, customer loss, and business disruption (including, without limitation, difficulties in maintaining relationships with employees, customers, and suppliers) may be greater than expected, (vii) the assumption of unexpected risks and liabilities, (viii) the outcome of any legal proceedings that may be instituted related to the Agreement or the transaction, (ix) the diversion of and attention of management of the Company on transaction-related issues, and (x) other risks detailed from time to time in the Company’s filings with the SEC, including our Form 10-K filed on February 21, 2020 and subsequent registration statements, amendments or other reports that we may file from time to time with the SEC and/or make available on our website. The Company assumes no obligation and does not intend to update the forward-looking statements provided, whether as a result of new information, future events or otherwise. Accordingly, you should not place undue reliance on these forward looking statements.

| CONTACTS: | |

| In the United States:

Bruce Entin Investor Relations Tel. +1-408-625-1262 Investor.relations@magnachip.com

Or

Dan Zacchei / Alex Kovtun Sloane & Company +1-212-446-1882 / +1-212-446-1896 |

In Korea:

Chankeun Park Director, Public Relations Tel. +82-2-6903-5223 |